Take Advantage of the Federal Commercial Geothermal Tax Credit

The Inflation Reduction Act (IRA) of 2022 offers energy-saving federal tax incentives for commercial projects utilizing geothermal water source heat pumps. The IRA contains federal funding for clean energy projects, with the goal of lowering the nation’s carbon emissions

Who’s Eligible

Equipment that uses the ground or ground water as an energy source for heating and cooling a building is eligible for the commercial geothermal tax credit. The system must be in the United States and only its owner can claim tax credits or depreciation deductions.1 After equipment is installed, the taxpayer must take legal title of the equipment and have all necessary licenses and permits needed for its operation. Starting in 2023, section 6418 allows for commercial taxpayers to transfer the credit to other taxpayers.

1. For the EPAct 179D tax deduction, the commercial building owner can take the deduction and for not for profit, government, or tribal government buildings, the designer can take the deduction. Equipment which uses the ground or ground water as a thermal energy source to heat a structure or as a thermal energy sink to cool a structure, but only with respect to property the construction of which begins before January 1, 2035.

How to Claim the Federal Commercial Geothermal Tax Credit

Use IRS Form 3468 to claim the ITC. The commercial geothermal tax credit can be used to offset both regular income taxes and individual alternative minimum taxes (AMT). If the tax credit exceeds the income tax liability, the loss can be carried back one taxable year and the remaining balance can be carried into future years. Use IRS Form 4562 to claim the 5-year and the one-time bonus depreciation. Commercial building owners can take the 179D for building projects completed since Jan 1, 2006. A standard form for 179D will be available within IRS Form 7205. To claim a 179D deduction, use the “Other” deduction line. IRS Form 3115 is used for catch-up on all prior year unclaimed EPAct 179D deductions. Designers of government projects must amend prior year returns and can only adjust the prior 3-years.

RJI is expanding!

We are moving our operations and combining office spaces with our sister company Electronic Support Systems (ESS) at their location in Bridgeton, Missouri.

The new space for RJI will provide additional office area and expanded warehouse opportunities. In addition, we will have a technical training center and our information technology(IT) will be supported by ESS’s on-premise data center. The critical infrastructure in the data center is equipped with Vertiv (Liebert) equipment including: UPS, in-row cooling, power distribution, racks and rack mounted power distribution. All of this equipment is tied into the iCOM and Packet Power monitoring.

This will be effective November 15th, 2021.

All email and phone numbers will remain the same. However, the mailing address will now be

Rollie Johnson, Inc. (RJI)

12926 Hollenberg Drive

Bridgeton, Missouri 63044

Please update your records with this address change for Rollie Johnson, Inc. (RJI) at your earliest convenience.

I acquired Electronic Support Systems (ESS) at the beginning of January 2021. ESS formerly known as ESP (Electronic Support Products) was a part of RJI’s portfolio of companies prior to 1992. When Liebert (Vertiv) made a representative change the new company was then formed in 1992 called Electronic Support Systems (ESS) that has represented the full Vertiv (Liebert) product line for many years.

RJI and ESS will continue to operate as independent business units to support the local HVAC and Critical Infrastructure markets.

The connected history between the two companies ESS and RJI has now come full circle after being apart for 29 years. The synergy of the companies will not only provide a larger footprint in the St. Louis construction market and surrounding area but will offer a greater array of products and services to ultimately provide engineered solutions to the customer.

Sincerely,

David Zimmerman, PE

Rollie Johnson, Inc. (RJI)

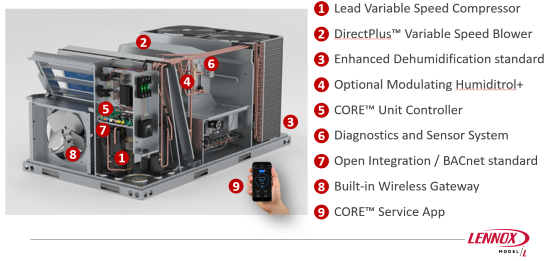

RJI Announces the Lennox New Multizone VAV RTU – Available for Shipment April 2021

With its innovative unit controller and advanced variable technology, the new Model L is engineered to maximize energy savings and provide complete comfort. But that’s just the beginning.

Premium diagnostic features reduce installation, service, and maintenance expenses to redefine the lowest total cost of ownership in the industry.

- Up to 23.5 SEER, 15 EER and 21.0 IEER

- 3-25-Ton Gas/Electric and Electric/Electric

- CORE™ Unit Controller

MultiZone VAV Operation

- Blower speed modulates to maintain duct static pressure

- Compressors control DAT

Contact RJI Sales, Inc. to discuss how we can help you meet your goals!